Banking on Qubits: The Quantum Revolution in Finance

In a world where financial markets are as volatile as a cat on a hot tin roof, the finance sector is turning to quantum computing for stability, efficiency, and that ever-elusive competitive edge. Think of quantum computing as the Formula 1 car of computing—built for speed, and precision, and to make classical supercomputers look like tricycles.

Big banks are the early adopters, and for good reason. We’ll delve deeper into why they’re leading the pack later, but let’s just say they’ve got the resources and the appetite for innovation. Meanwhile, a plethora of startups are also entering the quantum race, offering an array of solutions tailored for the financial sector.

It’s not just about having a shiny new toy; it’s about staying ahead in the game. Major financial institutions are not just dipping their toes but diving headfirst into quantum waters. They’ve even enlisted tech giants like Google and IBM to grant them VIP access to their increasingly sophisticated quantum machines. For example, Google is spending several billion dollars to build a functional quantum computer by 2029, according to the Harvard Business Review.

And the numbers speak for themselves. According to a 2023 report by Deloitte FSI Predictions, the financial services industry’s spending on quantum computing is expected to skyrocket. We’re talking about a 233x growth from just $80 million in 2022 to a staggering $19 billion by 2032, growing at a 10-year CAGR of 72%. Firms that invest in quantum capabilities today are like the early miners during the gold rush—poised to strike it rich as these technologies mature.

(Source: Deloitte)

Below, we demystify the quantum buzz and shed light on how this technology is revolutionising the finance sector—one qubit at a time.

The Quantum Computing Landscape in Finance

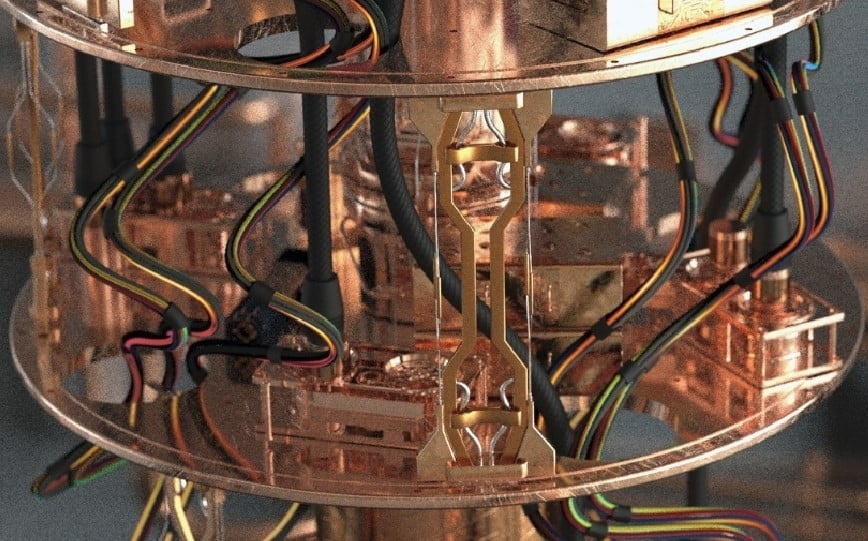

In the finance sector, the choice of quantum computing types is diverse. There’s the superconducting model, the Usain Bolt of quantum computing, known for its speed and efficiency. Then we have quantum annealing, the chess master, perfect for solving optimization problems that make Wall Street quants lose sleep.

But what’s the secret sauce behind these quantum marvels? Enter qubits, or quantum bits. Classical computing bits are like light switches that are either on or off (a state of 1 or 0). Qubits, on the other hand, are like dimmer switches. They can exist in multiple states at once, thanks to a phenomenon called superposition. This allows them to perform complex calculations at speeds that would make a supercomputer blush.

In essence, qubits are the building blocks of quantum computing, enabling these machines to tackle the financial sector’s most intricate problems.

Why Quantum Computing Over Supercomputing in Finance?

Let’s take a trip down memory lane to ancient Mesopotamia, where local kings and merchants were already dabbling in derivatives to hedge against the uncertainties of grain harvests and long-distance trade. Fast forward to today, and we’re still wrestling with derivatives, albeit with a bit more mathematical flair. Enter the Monte Carlo method, a statistical technique named not for a casino but for the inventor’s spendthrift uncle. It’s a workhorse for calculating the price of complex financial instruments like stock options. But here’s the problem: the computational prowess of classical supercomputers hits a wall when dealing with the intricate, exponential complexities of modern finance.

Imagine trying to seat 10 people around a dinner table in a way that maximizes pleasant conversation and minimizes food fights. The number of possible combinations is 10 factorial, written as 10! And computed as shown below:

10!=10×9×8×7×6×5×4×3×2×1=3,628,800 possible sitting combinations

That’s staggering, and that’s just for a dinner party. Now, scale that up to managing a portfolio with thousands of assets. It’s like trying to solve a Rubik’s Cube while juggling flaming torches.

Quantum computing, with its qubits and superposition, steps in like a maestro conductor, orchestrating these complexities with ease. It promises not just speed but unparalleled accuracy in optimization, simulation, and machine learning. In finance, thare many use cases with exponential complexity.

Quantum computing is the game-changer, turning financial quandaries into solvable puzzles, and perhaps making finance one of the first sectors to truly capitalize on this revolutionary technology.

Case Study 1: JPMorgan Chase & Co. and Quantum Computing

JPMorgan Chase & Co. (JPMC) is a multinational investment bank and financial services holding company headquartered in New York City. As one of the largest and most influential financial institutions in the world, JPMC faces a myriad of challenges in the rapidly evolving landscape of finance. These challenges range from risk management and portfolio optimization to fraud detection and data security.

Financial Resources and Technology Research

With a staggering revenue of $128.7 billion in 2022, JPMC has the financial muscle to invest in cutting-edge technology research. This has enabled the firm to delve into quantum computing, among other advanced technologies. The bank has been actively developing quantum algorithms focused on optimization, machine learning, and natural language processing, and has been transparent about publishing these results.

Type of Quantum Computing Used and the Number of Qubits

JPMC employs quantum bits (qubits) as the smallest unit of information in its quantum computing endeavors. Qubits can exist as one, zero, or both simultaneously, and when entangled in a closed system, they form a network-like structure. This, when combined with quantum algorithms, unleashes computational capabilities far exceeding those of classical computers. The exact number of qubits used by JPMC is not publicly disclosed.

R&D or Real-World Problem-Solving?

JPMC is one of the first financial institutions worldwide to invest in quantum computing and has built an internal team of scientists for this purpose. The focus is not merely on research and development (R&D); the bank is actively working on real-world applications to address business use cases in finance, AI, optimization, and cryptography.

Quantum Computing’s Impact

Quantum computing has already made a significant difference at JPMC. The program has produced new quantum algorithms for use cases such as portfolio optimization, option pricing, and risk analysis. In the realm of machine learning, applications range from fraud detection to natural language processing. Moreover, JPMC, in collaboration with Toshiba and Ciena, has successfully demonstrated a Quantum Key Distribution (QKD) network for metropolitan areas, resistant to quantum computing attacks. This prototype shows that the firm now has a proven and tested method for preventing quantum attacks, particularly in securing Blockchain applications.

JPMorgan Chase & Co. is at the forefront of leveraging quantum computing to solve complex financial problems. The bank’s substantial financial resources have enabled it to invest in this transformative technology, aiming to gain a competitive edge in the financial industry. As quantum computing continues to evolve, JPMC is well-positioned to lead the industry in adopting this groundbreaking technology for practical, real-world applications.

Enjoying this Content? Sign up to our news letter for more real world examples of Quantum Computing

Case Study 2: HSBC and IBM in Quantum Computing

HSBC, one of the world’s largest banking and financial services organizations, is no stranger to the complexities and challenges that the financial sector faces. From portfolio optimization to fraud detection and cybersecurity, the bank is constantly seeking innovative solutions to enhance its services and protect its customers. To this end, HSBC has been exploring the disruptive potential of quantum computing.

Type of Quantum Computing Used and the Number of Qubits

HSBC has entered into a three-year collaboration partnership with IBM to explore quantum computing applications for financial services. While the specific type of quantum computing and the number of qubits are not explicitly mentioned, IBM is known for its expertise in superconducting qubits and has a range of quantum processors with varying qubit counts.

Program Objective: R&D or Real-world Problem-Solving?

The partnership aims to investigate the potential of applying quantum technologies to real-world problems across the bank. HSBC is building a dedicated quantum research team and an in-house team of Ph.D. scientists to formalize use cases into deep research projects and develop patents and quantum products. This suggests that the program is geared towards both R&D and solving real-world financial problems.

How Quantum Computing Has Made a Difference

Quantum computing promises a step-change in computational power, capable of tackling highly complex tasks far beyond today’s machines. HSBC’s bank-wide quantum strategy focuses on integrating quantum computing into their products and services, improving processes, and preparing for a quantum-secure economy. The bank collaborates with a range of organizations like IBM, Fujitsu, and Quantinuum, as well as leading academic institutions and governmental organizations.

Case Study 3: Multiverse Computing

Multiverse Computing, founded by Enrique Lizaso, Roman Orus, and Sam Mugel, is a quantum computing startup that has caught the eye of leading investors such as EASO Ventures and Quantonation. With a substantial grant of $26.7 million, the startup specializes in providing quantum solutions for the financial sector, focusing on areas like optimization, risk analysis, and fraud detection. The challenge for Multiverse is not just in proving the efficacy of quantum computing but also in demonstrating its practical applications in a financial landscape dominated by traditional powerhouses.

Type of Quantum Computing Used and the Number of Qubits

Multiverse Computing employs quantum annealing to tackle complex financial problems. While the exact number of qubits is not publicly disclosed, the company’s robust financial backing and specialized focus suggest they are working with cutting-edge technology.

R&D or Real-World Problem-Solving?

Multiverse is committed to solving real-world problems. Their quantum solutions are designed for seamless integration into existing financial systems. The aim is to offer actionable insights and optimizations that can significantly impact the operations of financial institutions.

How Has Quantum Computing Made a Difference?

Multiverse Computing has been a game-changer in the practical application of quantum computing in finance. Their flagship product, Singularity, offers a suite of quantum algorithms capable of tackling everything from portfolio optimization to fraud detection with unparalleled speed and accuracy. The company’s significant financial backing and strong leadership have enabled it to push the boundaries of quantum computing applications in finance.

Implications and Future Prospects

The advent of quantum computing in the financial sector is more than a technological leap; it’s a paradigm shift with far-reaching implications. While today’s quantum algorithms are prototypes for future applications, they’re laying the groundwork for a new era of computational finance. The financial industry is in a unique position: aware that quantum computing is on the horizon but not yet fully operational for large-scale, real-world problems. This transitional period is an opportune time for companies to become “quantum ready,” investing in education, research, and development to prepare for the quantum advantage.

Different financial applications will reach this quantum advantage at varying times. For instance, portfolio optimization may see exponential speed-ups long before option pricing algorithms catch up. Identifying these “low-hanging fruits” can help companies prioritize their quantum computing initiatives.

Moreover, building a specialized team is imperative. Quantum computing is not a siloed technology; it requires a collaborative approach that integrates quantum expertise with other business functions. This ensures that when quantum advantage becomes a reality, the organization is not just ready but poised to lead.

Security is another critical consideration. The power of quantum computing poses a threat to classical cryptographic methods, necessitating the development of quantum-resistant algorithms to safeguard financial data and transactions.

Bottom Line

Quantum computing is revolutionizing the financial sector, offering unprecedented computational speed and accuracy in complex problem-solving. From JPMorgan Chase’s focus on optimization and machine learning to HSBC’s collaboration with IBM for quantum readiness, and Multiverse’s innovative Singularity platform, the industry is abuzz with quantum initiatives.

With global spending in the financial services industry on quantum computing expected to skyrocket, early adopters stand to gain a significant competitive edge. As we stand on the cusp of this quantum revolution, the key takeaway is clear: now is the time to invest in becoming quantum-ready, identifying immediate applications, and building specialized teams. The future is quantum, and for those prepared, the prospects are not just promising but transformative.

Dont Forget to singup for our free news letter covering Quantum Computing topics Today!