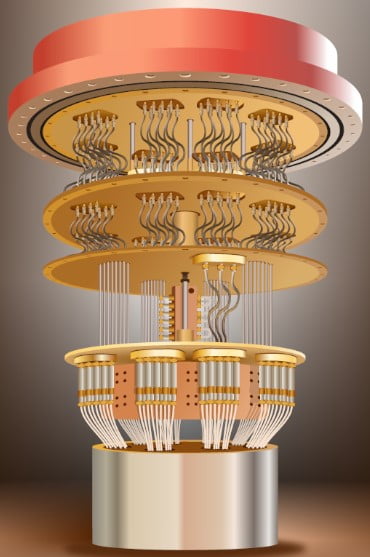

In January 2019, IBM Quantum System One became the first-ever universal gate , circuit-based commercial quantum computer. It is an integrated quantum computer with an airtight glass cube that maintains a controlled physical environment.

Prior to IBM launching the quantum computer, the tech firm tested it in Milan, Italy for two weeks in 2018. In June 2021, the American computer manufacturing corporation deployed the first unit of Quantum System One in Germany. It runs on a 27-qubit Falcon processor and has the potential to solve problems that classical computers cannot tackle.

Background Information

Nicknamed the Big Blue, IBM (International Business Machines) Corporation is an American multinational technology corporation headquartered in Armonk, New York, with footprints spread over 175 countries. Herman Hollerith, Charles Ranlett Flint, and Thomas Watson Sr. teamed up to establish the corporation on June 16th, 1911, making IBM the world’s oldest tech corporation. It specializes in computer hardware, software, and tech services, such as internet hosting and consultancy of mainframe and nanotechnology.

In the tech world, IBM has carved a niche for itself – for not being a well-run tech corporation and leading the pack in the research and development circus. As regards pioneering innovative QC research, the American behemoth partly achieved the feat because it has 19 research labs in dozens of countries worldwide, making it the world’s largest industrial research organization.

Before the tech corporation forayed into quantum computing, it had established itself as a household name in the classical computing space – an accomplishment it replicates in the QC ecosystem. IBM Corp. hinges its pioneering vision in the QC industry on quantum-centric supercomputing.

In 2016, the company announced that it had connected quantum computers to the cloud, allowing researchers to advance their QC experiments. The innovation would see the 112-year-old tech company release a host of ground-breaking research to revolutionize the global QC ecosystem. Years later, IBM unveiled its first quantum computer, IBM Quantum System One. To date, Big Blue remains the world’s leading QC firm for launching and scaling quantum computers.

IBM’s Strategy, Products, and Future Plans

IBM Corp. offers cloud access to its wide array of quantum computers. Whenever users (researchers, industry professionals, developers, and students) access these cloud services, they can learn, develop, and run programs using IBM’s quantum applications and systems.

The corporation develops the next-gen computers based on superconducting qubit technology. Big Blue employs many different strategies for developing and deploying its QC processors. For four years now, IBM has produced over 28 QC systems and devices. IBM has been scaling a series of quantum processors and QC systems since 2019. In 2020, the tech corporation drafted and released its QC development roadmap, which it follows religiously.

The tech corporation unveiled the 27 Falcon Chip with a 64 quantum volume from the famous Falcon family. In 2020, it launched the 65-qubit Hummingbird. The following year, Big Blue unveiled the 127-qubit Eagle, making the tech corporation the first to build a quantum computer with over 100 qubits. Still, in November 2022, IBM unveiled Osprey, the world’s most powerful quantum computer with 433 qubits.

From the roadmap, IBM will launch its 1121-qubit Condor and 1386-qubit Flamingo in 2023 and 2024 respectively. Once the QC giant unveils these QC computers, again, it becomes the first QC firm to build a QC system of over 1000 qubits based on the universal gate model. Indeed, the computer series is unique because no classical computers can simulate their algorithms.

By 2025, IBM will scale to 4158-qubit Kookaburra, which can run AI programs and allow for optimization. Though many critics argue that Big Blue is only taking baby steps to scale its quantum computers, the company is a constant reminder that taking the nascent technology from the labs to the markets on a large scale is achievable. In addition, IBM plans to build error-corrected QC systems by 2026, making its computers more business-centric and user-friendly.

As for its clients, Daimler-Benz, ExxonMobil, CERN, and Mitsubishi Chemical are some organizations already experimenting with the company’s quantum computers. The organizations hope to use IBM’s QC systems to deepen their knowledge of the innovative technology and enhance their operations in the future.

IBM’s Performance Generally

As one of the oldest companies the world has ever known, IBM went public on September 24th, 1915. You are right – that was over 100 years ago! In fact, the strategic business move earned IBM the first major corporation to go public with an initial public offering (IPO).

At that time, IBM’s name was Computing-Tabulating-Recording (CTR) Company – a name it changed to IBM nine years later. Big Blue, as many still prefer to call it, would later offer 500,000 shares for $100 per share and raised over $5 million in capital. In truth, every serious company that wishes to remain profitable in its space has to allot a significant amount of its resources to research and development.

Without a doubt, that’s one area IBM has performed excellently. In short, over several decades, the strategy has seen the tech corporation innovate and grow. Despite this, IBM has faced stern competition from other tech players such as Microsoft and Apple, which have been keeping an A-game in the tech landscape.

Furthermore, the tech company is listed on the New York Stock Exchange (NYSE) with the ticker symbol NYSE:IBM. Like all stocks traded on the stock market, IBM stock rises and tanks.

At the time of writing, it is currently trading at $123.45 per share with a market cap of $112.10 billion. Before hitting that ATH price in 2022, its ATH was around $134 in 2013. Historically, IBM is more of a reliable stock, but nothing near a goldmine. But then, there are strong indications that IBM stocks are undervalued.

Away from that, IBM has a diverse product portfolio in IT infrastructure, consulting, cloud hosting, cybersecurity, quantum computing, etc. Be that as it may, it is disappointing that its stock price has been declining since the tech corporation hit its all-time high, despite diversifying into new technologies.

You see, a glimpse of its 2022 financials shows that it generated $60.5 billion in revenue, representing a 5.5% increase from the preceding year’s revenue of $57.3 billion. Its gross profit also rose to $32.6 billion from the gross profit of fiscal 2021, representing about a 3.7% increase. On the other hand, its cash-at-hand figure for the quarter ending March 31st, 2023 was $17.592 billion, representing a 63.3% year-over-year increase.

The 2022 financial report represents more than 6% revenue growth in its decade-long financial performance. While the US tech behemoth forecasts between 3% and 5% revenue growth this year, financial analysts are projecting about 3.6%.

Key Capabilites of IBM

Many analysts consider IBM boring at this time because its performance has been unimpressive for about a decade now. Howbeit, it is not enough to write off yet for reasons you are about to see shortly:

1. Focus on big companies

Over the years, IBM has proven to its clients that it is a dependable ally for growing their products and services. Consequently, it is a no-brainer that about 45 to 50 organizations (chiefly financial institutions) that run on IBM mainframes will continuously do that for a long time.

As a future-looking company, IBM’s stint in cloud computing services has seen the tech behemoth serve about 94% of Fortune 50 companies. For cybersecurity, about 2/3 of Fortune 500 companies depend on its service to meet their business needs. The tech giant protects itself from disruptions by providing mission-critical services to a handful of big establishments. Put simply, serving these clients means shielding itself (and its investors) from a turbulent economic environment.

2. Increased Profitability and Dividend

Plus, Big Blue has maintained a steady cash flow in a while now. Though IBM’s projected cash flow for 2022 was $10.5 billion, it generated $9.29 billion in free cash flow. The cash flow supports the dividend, which yields 4.6%, meaning it would spend $6 billion on dividends in 2023. IBM paid $1.5 billion to shareholders in dividends in the 4th quarter of 2022.

And it pays an annual dividend of $6.60 per share, which translates to 5.03% per share on the current market price higher than its 4-year dividend yield of 4.93%. Moving on, by projecting a three-year free cash flow of $35 billion, the tech company plans to increase its free cash flow over the next couple of years. In other words, investors will get higher dividends in the coming years.

3. Expanding into new technologies (innovativeness)

If a business fails to plan, then it plans to fail. At IBM, the team isn’t just planning but taking strategic steps to rev up its earnings. From engineering IBM Personal Computer (model 5150) in August 1981 to deeply diving into new technologies (such as cloud computing, artificial intelligence, blockchain technology, and quantum computing), IBM has always been on the forefront of innovation.

Due to its commitment to keep the tech corporation profitable in its dog-eat-dog business milieu, IBM CEO Arvind Krishna coalesced the corporation into the twin pillars of artificial intelligence and cloud computing. As a result, its software division – where its artificial intelligence and cloud computing revenue comes from – accounted for $5.9 billion in the fiscal 2022 first quarter’s total of $14.3 billion.

A Snashot a IBM’s Commericals

Much as IBM remains the biggest tech company worldwide, its has historically underperformed when compared to those of tech giants like Apple and Microsoft. To make matters worse, Big Blue is high in indebtedness like the $54 billion worth of debt on its balance sheet (of which $46 billion is a long-term debt).

Now, let’s analyze the risks:

The Good

- IBM is currently profitable

- Its financial data is readily available

- It has not recorded any disturbing incidents in recent times

- No share dilution over the past year

- IBM has $60.5 billion in revenue and a market cap of $112.10 billion

- Has no negative shareholder equity

- Earnings are expected to grow by 21.4% per year for the next three years

- Share price has been relatively stable for the past three months

To Consider

- Its operating cash flow doesn’t cover its debt

- A dividend of 5.38% is not well covered

- Large one-off items impacting financial results

- Profit margins (3.4%) are much lower than last year’s (8.5%)

In summary, IBM remains a strong Quantum Computing organisation with ambitious goals and the backing to make considerable impact in the short and long term. We will keep a close eye on new announcements as IBM develops their next QC iteration.