For a quick intro, Nvidia Corp. is a US artificial intelligence (AI) chipmaker that designs graphics processing units, application programming interfaces, etc. It generates annual revenue of $26.97 billion and has a staff strength of 26,196. In April 1993, the tech corporation was incorporated in Delaware but sited in Santa Clara, California.

In March 2023, the leading chipmaker announced that it partnered with an Israeli Quantum Computing center to deploy the new DGX Quantum, which allows researchers and developers to write hybrid algorithms. The Israeli R&D center aims to facilitate the building and development of Quantum Computing systems for economics, security, engineering science, etc. With this move, the US chipmaker launched into the burgeoning quantum computing industry. This strategy will help form Nvidia Quantum Computing capabilities into the future.

Being a prominent name in the evolving world of artificial intelligence, Nvidia Corp. is positioning itself to play a pivotal role in the Quantum Computing industry. According to Research Dive, the demand for AI accelerators, such as GPUs, CPUs, and data processing could grow at 39% by 2031, generating $332 billion in annual revenue.

As the American chip company is taking bold steps to rocket its market share in the Quantum Computing world, many pundits don’t seem to be paying attention to how its daring moves positively shape its stocks. Indeed, the outcome has been excellent, thereby keeping many investors in a bullish mood. But how has the NVDA performed so far?

How Have Nvidia Performed in 2023?

Listed on the NASDAQ, Nvidia (NASDAQ: NVDA) started year 2023 with a mind-blowing outlook. Credible market sources indicate that share prices have nearly doubled in the first quarter (January through March).

To better appreciate Nvidia as a company so far, it is crucial to review their past performance. Recall that in 2022, NVDA tanked significantly, leaving many investors worried sick about the future of the chipmaker. In comparison with today’s performance, it is safe to say that it has grown by more than 80%.

When you consider that Nvidia snagged a near-perfect IBD Composite Rating of 98%, you understand why lots of investors are falling over themselves.

In simple terms, the Nvidia outperformed 98% of all the stocks the platform tracks – in terms of combined technical and fundamental metrics. Regardless of the perspective you look at it from, the performance is a big deal.

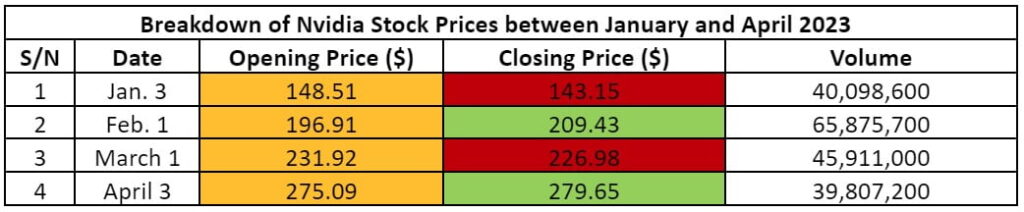

The table above captures the performance of Nvidia stocks between January and April 2023. In a nutshell, one can deduce that when trading resumed on January 3rd, NVDA stocks opened at $148.51 and closed at a negative price of $143.15.

However, over the time, the prices increased to $279.65 while trade volumes dropped from 40,098,600 on January 3rd to 39,807,200 on April 3rd. Without a doubt, the price increase indicates that more and more investors are bullish on the company’s stocks.

Factors Positively Driving Nvidia Growth

Deepening AI Applications

More than ever before, artificial intelligence is increasingly getting the attention of investors worldwide. Indeed, this is one space where Nvidia has demonstrated its dominance and capacity. Little wonder AI has become the catalyst for the meteoric rise the Nvidia stock prices have witnessed since the beginning of the year. For instance, in March 2023, the chipmaker announced a set of cloud services that help businesses build and run generative AI models.

According to CEO Jensen Huang, Nvidia was currently experiencing an “iPhone moment” in the AI industry. In the global AI community, the term “Generative AI” has become a buzzword. The chief executive explained that they intend to take AI to every industry. In addition to that, the chipmaker reached a deal with cloud computing giant Amazon.

The two partners plan to work together to drive down the cost of AI model training by 40%. By increasing the industry’s demand for its AI products, the Nvidia stock prices will continuously scale.

Formidable Fundamentals

Aside from the great strides the chipmaker has made in the AI space, another factor catalyzing the growth of their stock is its formidable fundamentals.

Those are the quantitative and qualitative factors that give all stocks, including Nvidia stocks, their intrinsic (true) value because they determine the value or worth of the business.

These strong stock fundamentals have influenced the steady rise of the NVDA stock prices in more ways than one. For instance, Nvidia closed trading at $143.15 per share on January 3rd.

However, on April 3rd, they closed trading at $279.65 per share. The change indicates an upside of 95.4% in a little over three months. Sure, that is an incredible growth spurt that is way higher than most public companies.

Nvidia fundamentals remain intact, making the chipmaker favourable for investors and experts to assign them higher-than-market multiple.

There is also a strong indication that its formidable stock fundamentals and secular growth tailwinds will rocket the stock prices in the coming months, thereby making more investors richer, keeping more investors optimistic about the future of the stocks, and strategically positioning NVDA as a must-buy stock.

Impact on the GPU Market

Concerning the GPU (graphic processing unit) market, Nvidia is in the league of its own. You see, GPU (also known as visual processing unit) is a computer chip that solves computational puzzles rapidly. The simplest way to describe the role of Nvidia in the GPU industry is having a monopoly-like position. As the cloud computing and AI markets grow, Nvidia stocks continuously surge.

Let’s break that down for you. Microsoft recently invested $10 billion in OpenAI. On the other hand, Research Dive projects that the chatbot market will generate an estimated revenue of $19.5 billion by 2027. Microsoft launched the generative AI app, ChatGPT, on its Azure cloud platform to get the most out of the generative AI tool.

In other words, Microsoft has become a top player in the chatbot market. You are probably wondering how all this affects Nvidia. Well, the chipmaker provides the underlying technology that drives the AI race. In a simple sentence, it supplies the fuel that tech companies in the AI race (such as Microsoft and Alphabet) need to arrive at their destination.